As part of our ongoing commitment to keep lines of communication open between Crown and our customers and clients, we’re introducing a bi-monthly Moving Industry Bulletin. In each issue, we’ll focus on this challenging period’s impact on the service delivery landscape. Ad-hoc bulletins will also be issued as needed should matters arise that require more frequent communication.

clients, we’re introducing a bi-monthly Moving Industry Bulletin. In each issue, we’ll focus on this challenging period’s impact on the service delivery landscape. Ad-hoc bulletins will also be issued as needed should matters arise that require more frequent communication.

September’s edition covers the continuous increase in freight rates, decreased vessel capacity and container shortages, as well as other potential disruptions:

- – Freight rates continue to rise

- – Decreased vessel capacity and container shortages continue to cause severe delays

- – Other potential disruptions

Freight rates continue to rise

While Covid has caused challenges in providing cross-border moving services, specifically in the areas of labor restrictions and availability, packing material shortages, trucking availability and PPE-related protocols, it is in the areas of vessel and shipping container availability and increasing freight rates that the largest disruptions continue to occur.

Over the past year, we’ve seen widespread service disruptions and freight rates increasing dramatically in the global container shipping market with no expected improvement over the next six months. The prospect of continuing problems until the end of 2022 is looking increasingly likely, meaning rates may remain extreme for another year.

Source: Drewry Supply Chain Advisors; Container Freight Rate Insight

The average freight rate for a 40ft shipping container has increased by approximately 300% over the last year and approximately by 10% since July. Primary reasons for the rising freight prices remain the same: ongoing delays, cargo backlogs, and congestion at container ports worldwide in addition to the shortage of berthing space and 40ft equipment. The peak season is also contributing to these rising rates.

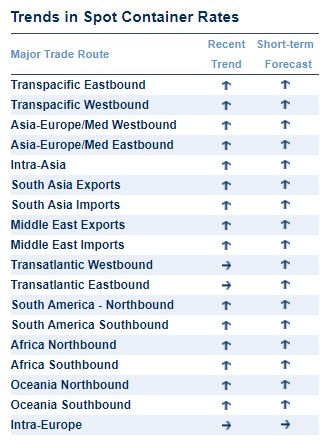

Drewry, a world’s leading independent global maritime advisory and research organization, expects freight rates to keep increasing on almost all major East-West and North-South trades through September. This is due to inflated bunker (fuel) prices, the aftermath of typhoons, new Covid outbreaks at Chinese and Australian ports, the cyber-attack at South African ports and ongoing supply-demand disruptions.

Decreased vessel capacity and container shortages continue to cause severe delays

In general, most countries are currently experiencing decreased vessel capacity on both inbound and outbound routes, as well as shipping container shortages for household goods shipments. These issues are impacting the ability to move shipments in a timely manner and customers are being advised to expect much longer transit times than normal.

Crown is currently recommending to clients and customers that the logistical planning of a moving service takes place six to eight weeks before the intended departure date from the origin country.

Beyond these global issues that are causing shipment delays, the following section notes additional challenges that may cause further disruption in the provision of moving services to customers.

Other potential disruptions

- Longer export and import customs clearance times as officials are not fully functional.

- Temporary storage charges may be incurred at origin while waiting for container and/or vessel availability or export customs clearance.

- Potential port storage or demurrage charges may be incurred at destination due to delayed import customs clearance procedures.

This summary was prepared using information obtained from Crown World Mobility’s and Crown Relocations’ Global Operations Team, Crown’s preferred Partner network, Drewry, as well as trade publications. If you have any questions, or would like further information about the content of this bulletin, please get in touch with your Crown Account Manager or another one of our experts.